DeFi Pulse Farmer #15

Catch up on a new week in DeFi as we recap a new TVL all-time high, the best performing DeFi tokens of the week, the Farm of the week, the most trending stories in DeFi, and Governance, and more!

Welcome to the fifteenth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, and the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

Looking to catch up? We’ve got you covered!

If you prefer, you can read today’s edition directly on DeFi Pulse Farmer.

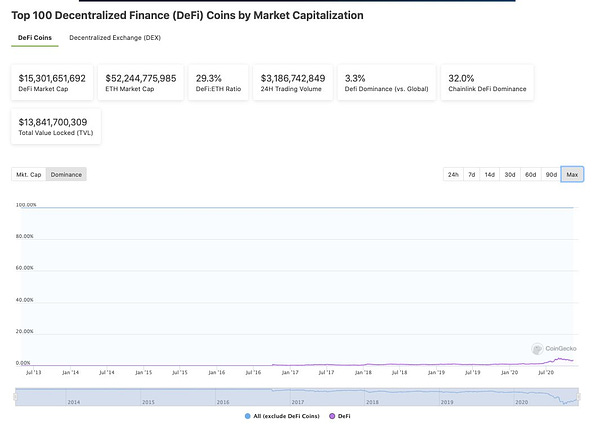

The total value locked (TVL) in DeFi has been uptrending for two weeks in a row now, rising from $11B to a new all-time high of $13.95B in that span. Even though it’s now slightly down to $13.65B, the $14B club is right around the corner!

Zooming out, over the last day Uniswap notably became the first DeFi app to cross the $3B TVL mark after being the first to cross the $1B and $2B milestones as well. Top lending protocol Maker, the second-largest dapp right now, is the closest behind Uniswap in having risen to a TVL of $2.35B as of today.

This week the bitcoin price climbed above $16,000 for the first time in three years, a dynamic that’s pushing tokenized bitcoin project WBTC, into the limelight like never before.

It’s also notable that MakerDAO hit the mark of 1B DAI, making it the decentralized stable coin with the largest supply in DeFI.

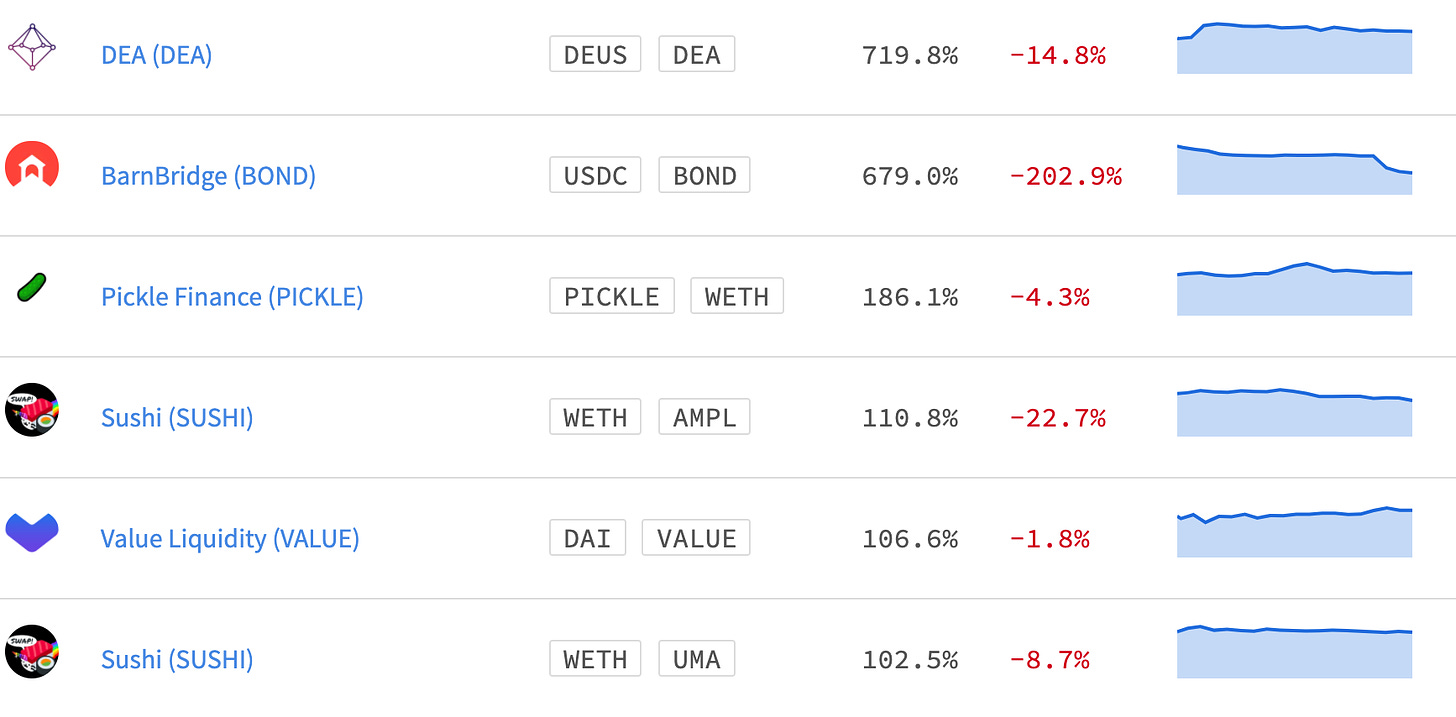

As for individual tokens, it was an amazing week for DeFi upstarts and blue-chips, with some of the best performers over the last 7 days being INDEX (+224%), AAVE (+65%), CRV (+51.4%), MTA (+47.9%), UNI (+47.9%), and YFI (+46%). The DeFi Pulse Index (DPI) had a great run, too, rising 27.3% to $89.76 since this time last week.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier through their XTF token funds.

Bundle assets with available 61 supported tokens and mint creative new XTF token funds via DEXTF!

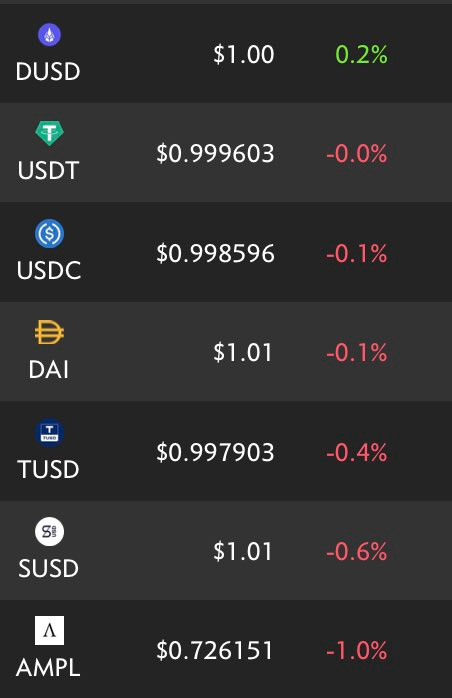

Stablecoin index project DefiDollar is one we may be hearing a lot more about going forward. Why?

While DefiDollar may be a newcomer to the stablecoin arena, its protocol is already capably providing a superior shield against volatility and safety through diversification -- two things DeFi users are increasingly clamoring for.

These advantages spring forth from DefiDollar’s DUSD token being index-based, i.e. being a meta-stablecoin that’s based upon other stablecoins and Curve liquidity provider tokens including DAI, TUSD, USDC, USDT, yCRV, and yUSD. This system ensures users can stabilize their USD-denominated holdings without being overly exposed to a single token, e.g. if projects’ pegs slip or worse yet break altogether.

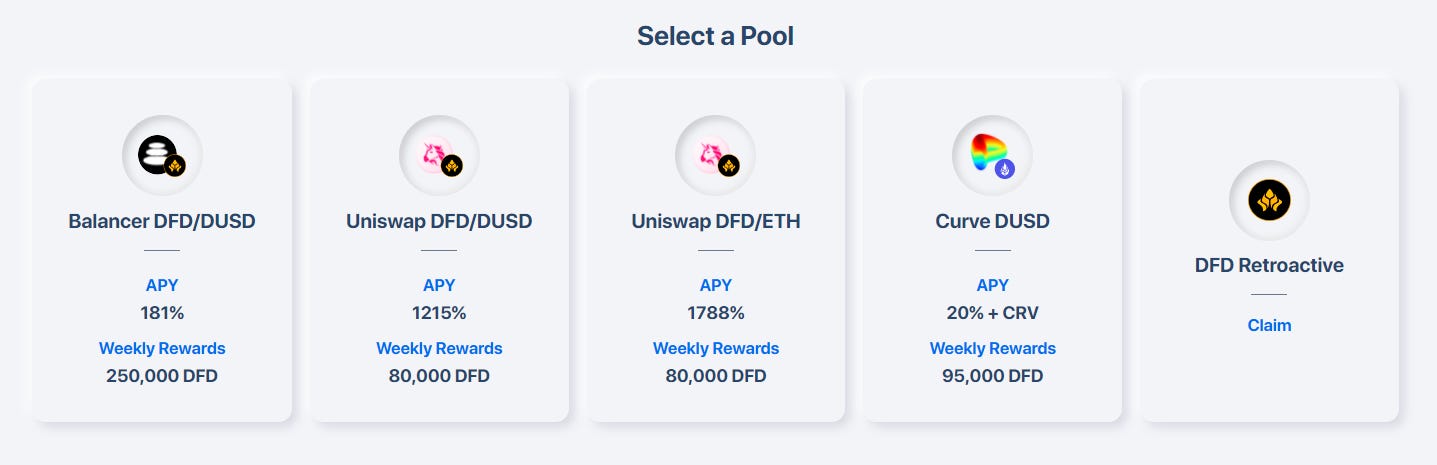

DefiDollar’s New Farms

It’s an interesting time to dive into DefiDollar because the project’s team just launched a series of bootstrapping-minded farms around DUSD and the protocol’s governance token, DFD.

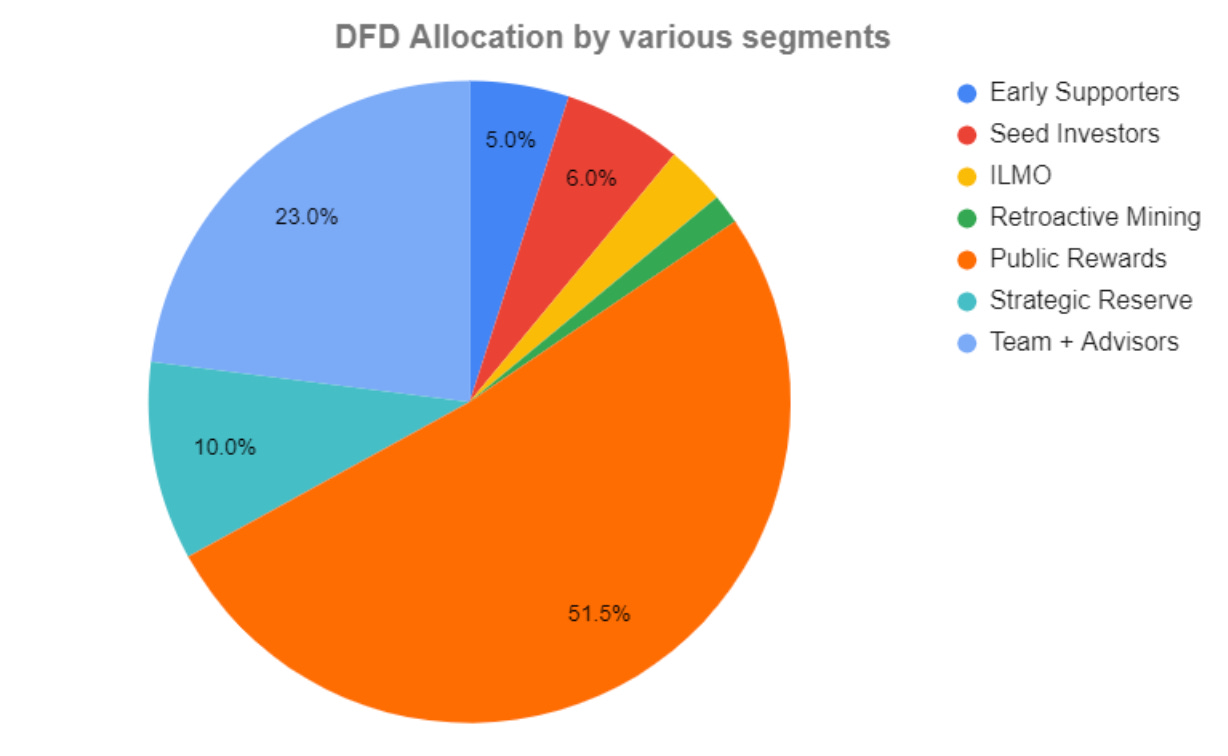

First, some quick context. DFD has a 100M total supply, 56% of which has been set aside for community incentives. A significant portion of these rewards have been slotted to a multi-pronged liquidity mining program centered around the DUSD and DFD tokens.

More details on the DFD allocation here

The pools active in this program right now include:

181% APY currently

250k DFD in weekly rewards

1,215% APY currently

80k DFD in weekly rewards

1,788% APY currently

80k DFD in weekly rewards

20% APY + ~9.5% from CRV rewards currently

95k DFD in weekly rewards

When it comes to any of the non-Curve pools your farming flow will look like this:

Pick up DFD for providing liquidity.

Add liquidity to your pool/pools of choice (you can use the links listed above).

Stake your LP tokens through DefiDollar’s LP Rewards page.

As for the Curve DUSD farm, you’ll just want to keep in mind that you have to stake your pool LP tokens in the Curve gauge to earn both CRV and DFD rewards.

And that’s how these farms work! They’re straightforward and since they all have different characteristics, there’s essentially something here for any farmer. But remember: these APYs will undoubtedly fluctuate, and these pools have risks like impermanent loss (IL). Do your own research, and never plow with more money than you can afford to lose!

Note: Alpha Tractor subscribers can also check out our previous Protocol Express featuring DefiDollar for more insights and all subscribers can get more information on how to stake on Curve on the Conservative Farmer section on DeFi Pulse Farmer #4, and DeFi Pulse Farmer #5.

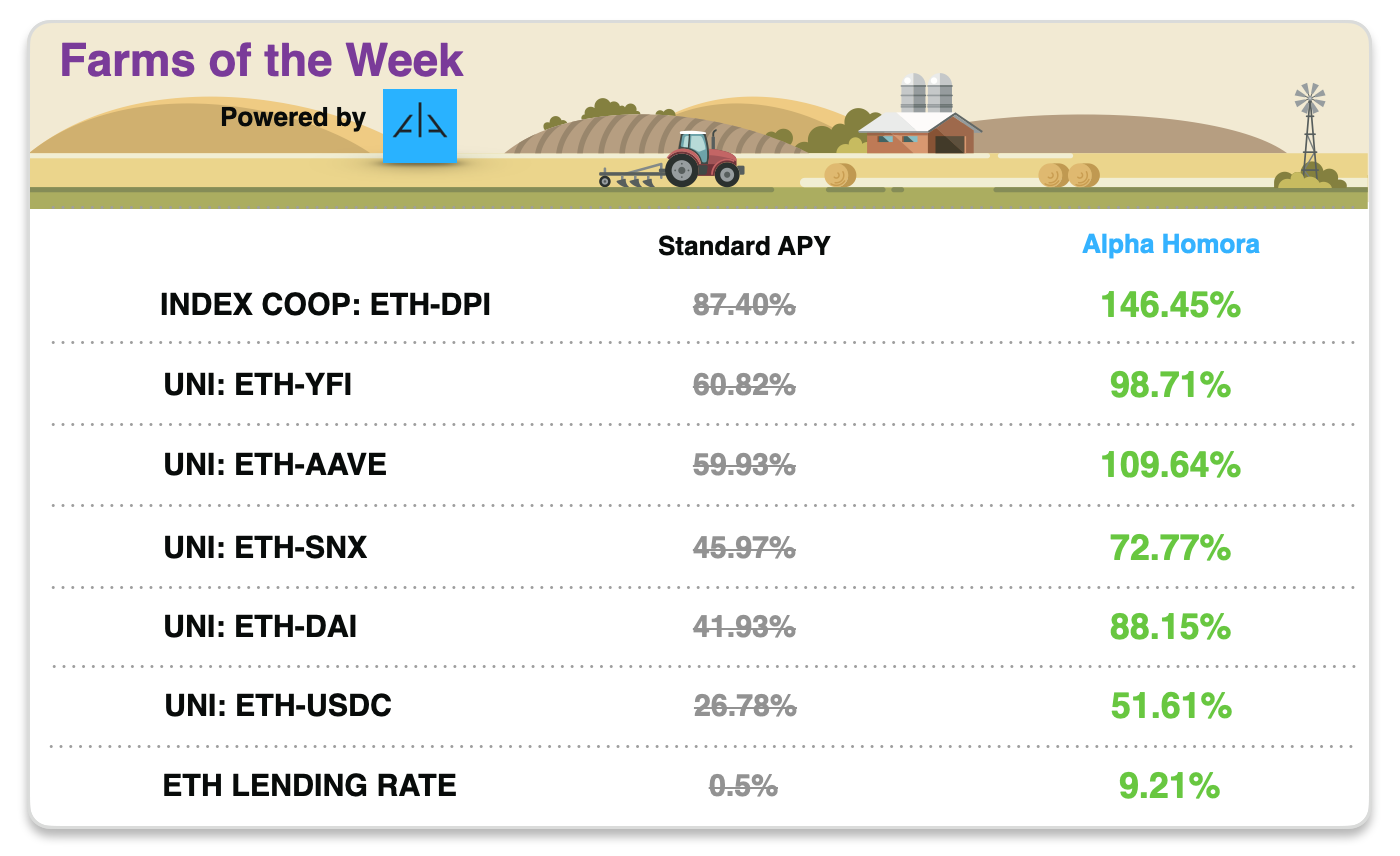

Farmers can enhance this week’s farms with our sponsor Alpha Finance, which is focused on building out an ecosystem of cross-chain innovative and user-friendly DeFi products.

APYs shown above don’t take into account Alpha Homora’s own liquidity mining program. Alpha Homora is conducting its own liquidity mining to those who open leveraged positions (more than 1x) and those who provide liquidity to ibETH/ALPHA pair on Uniswap through Alpha Homora or Uniswap directly. Don't forget to head over to Alpha Homora and check out the 23 total yield farming and liquidity providing pools!

yearn.finance x Hegic: Options

TLDR: yEarn’s Andre Cronje is working with Hegic’s tech to create binary options products.sOIL and iOIL now live on Synthetix, Powered by Chainlink

TLDR: Synthetix launches sOIL and iOIL, non-expiring crude oil indexes based on ICE Brent Crude Oil futures prices.MoonSwap Resumes Its Asset Migration

TLDR: MoonSwap, a layer-two AMM, hosts an asset and liquidity migration from Uniswap.So you want to use a price oracle

TLDR: Whitehat hacker Samczsun discusses price oracles and details how DeFi projects can protect themselves from price oracle manipulation.Pantera Capital and Alameda Research Invest in Balancer

TLDR: Two high-profile crypto firms make strategic purchases of BAL from the treasury of Balancer Labs.Aave V2 is Available on Public Testnet

TLDR: Aave’s optimized V2 system is now live on Ethereum’s Kovan testnet.Infura Mainnet Outage Post-Mortem

TLDR: Ethereum infrastructure provider Infura outlines how it weathered its worst service outage to date.Introduction to MakerDAO Collateral Onboarding

TLDR: Maker releases the “Collateral Onboarding Handbook,” a comprehensive guide for helping token projects onboard their assets into the lending protocol.Alpha Finance Lab launched Alpha Homora’s Liquidity Mining (Part 2A) and Trading Volume Mining (Part 2B)*

TLDR: Alpha Finance announces rewards for those who open leveraged positions (more than 1x) and to those who provide liquidity to ibETH/ALPHA and ETH/ALPHA pools.

*This is part of our sponsored links series.

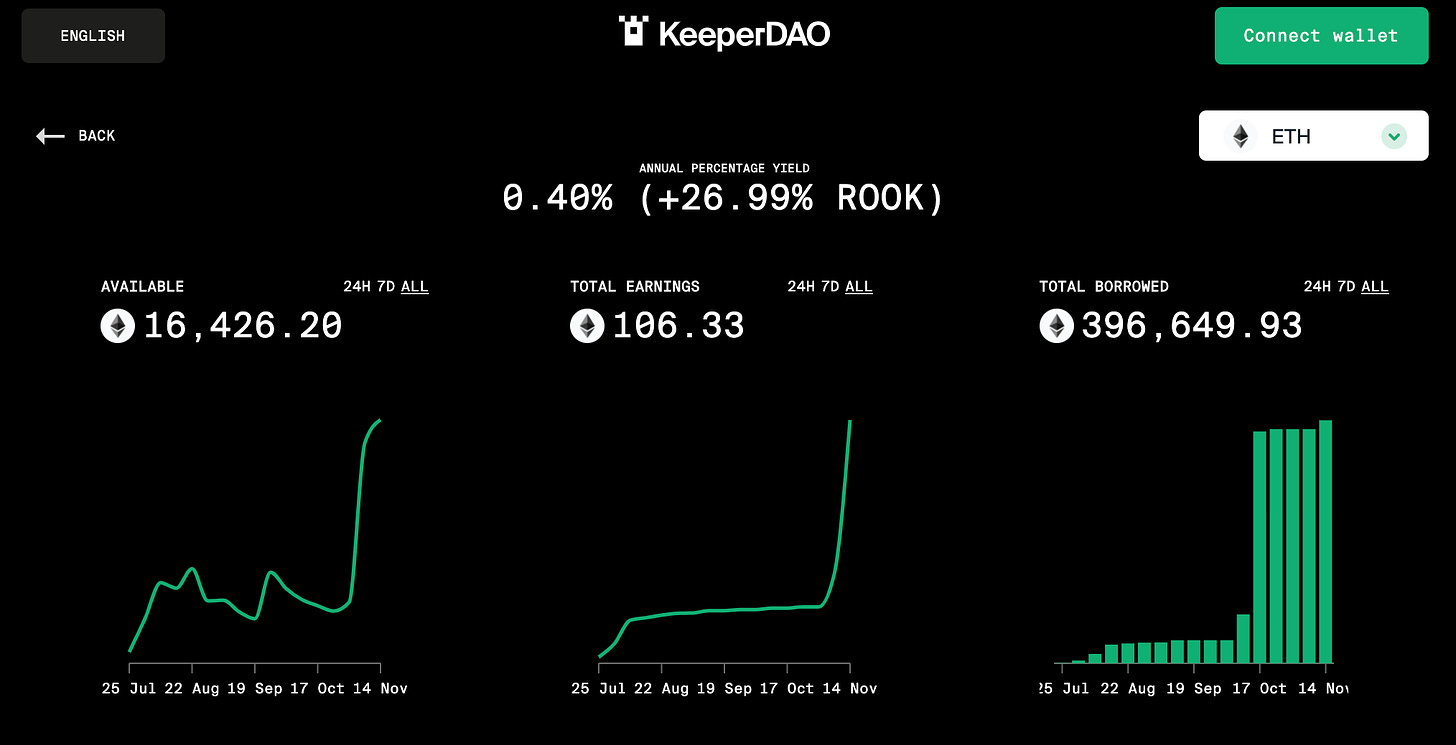

Farm up to 27.4% APY on Keeper DAOs ETH Pool

Every time there’s an exciting opportunity for an ETH pool, we love to share it. Last week it was Harvest’s ETH pool. Today is the turn for KeeperDAOs ETH pool, which currently offers up to 27.4% APY rewards, mainly provided in ROOK, KeeperDAOs governance token.

KeeperDAO is a protocol that incentivizes farmers to participate as arbitrageurs, liquidity providers, and more. You can think of it as a game-theory machine. Alpha Tractor subscribers can also check out our previous KeeperDAO Alpha Tractor here for more details.

How to farm ROOK on KeeperDAO by providing ETH liquidity

Farmers need to head to KeeperDAOs ETH pool here.

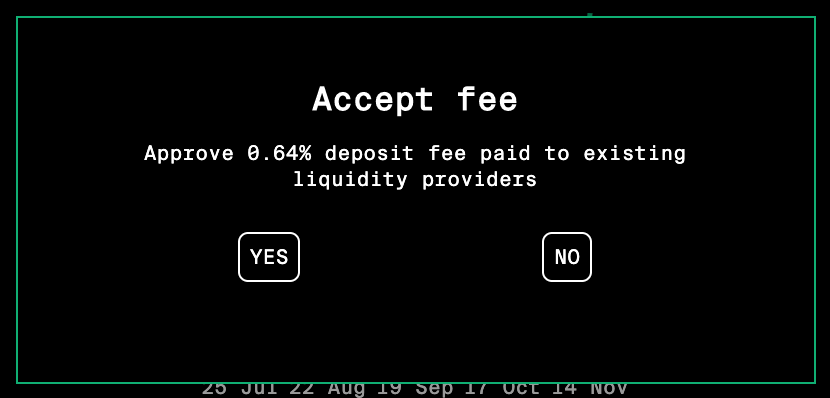

When hitting the “Deposit” button, farmers will get the following request for approval:

Source: KeeperDAO Please remember that depositors are charged an “instant fee” of 0.64%, which is paid to prior depositors and charged against kTokens when depositing assets, so make sure to add that to your math before providing liquidity in KeeperDAOs pools.

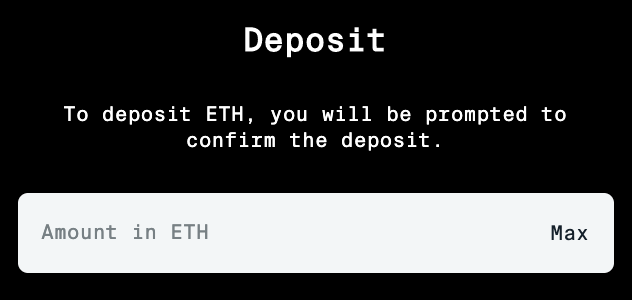

Select the amount of ETH you want to provide and hit “Deposit” once more.

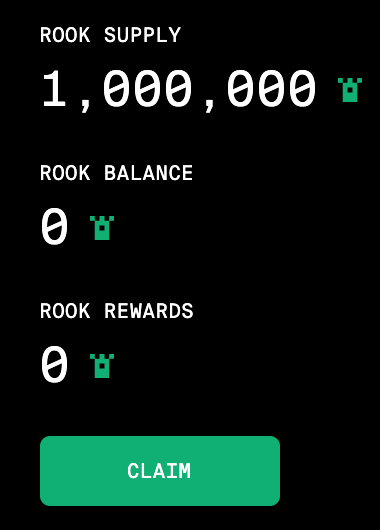

Source: KeeperDAO And that’s it; from that point on, you will start generating returns on your ETH, which you can later claim from the “Claim” section on the homepage.

Source: KeeperDAO

Synthetix proposes a delegated governance council called The Spartan Council.

Curve proposes metapools for “either/all” BUSD, PAX, and TUSD.

Research firm Delphi Digital proposes a new AAVE token structure.

Compound re-proposes delegating cUNI’s market liquidity to Compound’s community multisig.

This week’s plow of the week goes to DeFi Ethereum Wisdom, a DeFi APY tracker that allows farmers to compare between pools’ performance across different protocols easily. You can also check out their Telegram group here to get quick alerts on new pools added!

Who said the DeFi summer was over? After the market was down a few weeks ago, DeFi has shown its antifragility once again. Even though the previous exuberance seems to be washing out, quietly, DeFi tokens have gone up, projects such as MakerDAO continue to reach outstanding milestones, and ETH yesterday went up briefly to $475.97, its highest price in the past 180 days. If one thing’s for sure, DeFi is just getting started.

Enjoy your weekend, until next week!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!