DeFi Pulse Farmer #4

Catch up on a week for the DeFi history books as we recap Aave, Governance Wars, ETH ATH on DeFi and more.

Welcome to the fourth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

Looking to catch up on the past month? We’ve got you covered!

Farm Whisperer

“Yield Farming via staking DeFi tokens is a novel marketing strategy that taps into existing enthusiast communities to accelerate distribution. Combine this with governance wars and inter-community skirmishes are going to get really interesting soon…”

Kain Warwick, Founder, Synthetix.

DeFi Recap

DeFi continues to surge with Total Value Locked (TVL) breaking new ATHs week after week. With more than $700 million added in the past week, TVL now stands at $8.64B. At this pace, the 10 billy club could be here in the next two weeks!

More importantly, ETH TVL also reached its ATH, with 4.45% of the total supply now locked in DeFi 🎉.

Aave received a full electronic money authorization for its UK subsidiary, allowing them to facilitate payments, currency conversions, and issue electronic money accounts for consumers and businesses. This marks a new milestone in the industry, as Aave will now bridge traditional finance and DeFi. For perspective, the only other two companies in the UK with this license are Coinbase and Revolut. No wonder Aave is #1 on the DeFi Pulse Leaderboard.

Governance wars have started. Holders of yEarn Finance decided to allocate their CRV treasury ($2.5M) to Curve Finance, taking advantage of their 2.5x rewards multiplier while gaining political power. Curve's team quickly responded by locking the team's CRV tokens, kickstarting a flurry of attention around the hottest governance token on the block.

Later Curve modified their allocation and now no participant owns more than 27% of the voting power.

Finally, DeFi tokens continue to surge. BZRX has quietly gone parabolic, with its protocol relaunch on August 31st driving the token up 114%. UMA, is close behind, up 70% in the past week.

Token or Die

Tokens are the talk of the town. Any new project is immediately bombarded with ‘wen token’ requests in community channels. This sentiment is equally as hot behind closed doors, with any and all untokenized projects (of which there are now few) being prodded by investors to tokenize anything and everything to take advantage of the current hype cycle.

But, let’s not get lost in the sauce. One of the biggest problems with 2017 was trying to fit a square peg in a round hole. We are now entering a similar territory. Governance is great.

Letting the community govern protocol fee allocation is better. Using a token as a marketing ploy is not. When the dust settles, only those with true product-market fit will remain.

Be careful of those which genuinely need a token and those who rush to market to capitalize on yield farming.

Stories of the Week

Zapper Closes a $1.5M Seed Round

TLDR: The people’s choice for DeFi accessibility closes a seed round led by

Framework Ventures and Libertus Capital.Fair Launch Capital seeks to redefine equitable token distributions

TLDR: Prominent community members are forming a collective to provide teams with grants for security audits following no-premine, no presale launches.Arc Announces Maker for Everything

TLDR: A new DeFi game looks to make composable debt gamified following a forthcoming audit.Synthetix Introduces the Pollux Release.

TLDR: Synthetix enjoys a protocol upgrade with Chainlink price feeds, new rewards staking rewards, and trading incentives.MTA Staking Update

TLDR: mStable Announces Rewards for Staking MTA for Recollateralisation and Governance.DefiDollar is Live!

TLDR: Defidollar goes live following audits from Peckshield and Quantstamp, hitting its $3M debt ceiling within one hour.MEME Launches NFT-based Yield Farming

TLDR: What started as a rip on degen farming has blossomed into a full-blown product to lock token to mint limited edition NFTs.Delphi, a One-Stop Curated Shop for DeFi Yield Farming, Savings & Dollar-Cost Averaging

TLDR: Akropolis launched Delphi, a Yield Farming aggregator tool, and hit its $5M ceiling within one hour.

Governance Watcher

Compound introduced a proposal to reduce COMP emissions by 20%.

1% of the YAM Treasury will go to Gitcoin Grants for Public Goods Funding.

ParaFi Capital Introduced Proposal to add YFI as Collateral in MakerDAO.

Want your company featured here? Fill out this link to be the first DeFi Pulse Farmer sponsor!

Farm of the Week

Harvest 245% with BAL Liquidity Staking

We wrote about it this week’s Alpha Tractor. Did you listen?

With Balancer’s new Liquidity Staking implementation, useful BAL-based pools are taking the lion’s share of Balancer’s weekly liquidity mining rewards.

Of the 145k BAL distributed each week, 45k is going to select BAL pools paired with uncapped assets like WETH, USDC, DAI, and WBTC.

The 66/33 BAL/WETH appears to be netting the highest return at the time time of writing. Other pools can be tracked here.

Source: pools.vision

Liquidity has been flowing in steadily over the past week, and yet APYs still sits north of 200%. With the price of BAL climbing, it would appear that this strategy is one that BAL whales are embracing with open arms.

Source: pools.vision

Here’s a look at estimated returns for farmers entering with $10,000 worth of capital ($6.7k in BAL and $3.3 in ETH).

Farmers can get their hands on BAL directly through the Balancer exchange and enter the pool here.

Please keep in mind that rewards do not account for the impermanent loss, meaning that if the price of BAL outperforms ETH, you will lose a portion of your BAL holdings due to the weighted rebalances.

The Conservative Farmer

Choose the most convenient Curve pool according to your profile risk

This edition features the first installment of a new tool to make informed decisions when chasing those sweet yields across the different Curve pools. Stay tuned for more next week!

As a farmer, do you prefer exposure to:

A- Stablecoins

B-BTC

A- Stablecoins

Stablecoins offer the lowest possible volatility risk when farming. So if you’re feeling conservative, this is the farm for you.

To harvest alpha with stablecoins on Curve:

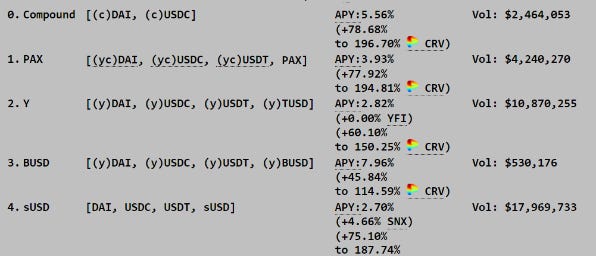

Here you can see an example of the pools returns:

Source: www.curve.fi

Remember to check the current APY before making a decision. Farmers can check the current APYs at the bottom of Curve’s homepage and can check the current stability of the Curve pools here (these do not include fees and extra tokens’ APY).

Here’s an example of our estimations for the different stablecoin pools for you to compare:

Make sure stablecoins are in your wallet. The best place to acquire them is either on Uniswap or Balancer.

Click on any of the pools and stake your tokens.

BONUS: If you want to also receive CRV rewards you should stake the LP position via the Compound gauge for CRV rewards (extra risk + gas).

Please be advised that staking in any of these pools has a minimum cost of $20 and that, if you don't trust any of the basket assets on any pool, then you should ignore that pool.

B-BTC

If you’re a little more tolerant of price volatility, this option is for you. Luckily, Curve pools mitigate impermanent loss. However, the price of BTC itself can change drastically. Farm with caution!

To gain exposure to farming with BTC on Curve:

Go to the renBTC Pool or the sBTC Pool.

Make sure you have a wrapped version of BTC to access the pools. Here are a few links to get some sBTC, wBTC, or renBTC on Uniswap.

Here you can see an example of Ren and sBTC pool returns. Please ignore the "to" APY as it shows APY for the max boost:

Source: www.curve.fi

Remember to check the current APY before making a decision. Farmers can check the current APYs at the bottom of Curve’s homepage and can check the current stability of the Curve pools here (these do not include fees and extra tokens’ APY).

Here’s an example of our estimations for the different BTC pools for you to compare:

3.BONUS: If you want to also receive CRV rewards you should stake the LP position

via the Compound gauge for CRV rewards (extra risk + gas).

Please be advised that staking in any of these pools has a minimum cost of $20 and that, if you don't trust any of the basket assets on any pool, then you should ignore that pool.

Locking your CRV Rewards

Remember that all pools on Curve provide you with CRV rewards when staking the LP position in a gauge. As of this week, farmers now have the option to lock those rewards to boost yields even further.

In next week’s edition, we’ll show you how to lock your CRV rewards to get that sweet extra yield!

Alpha Leaker of the Week

Closing Thoughts

With another week in the books, DeFi doesn't appear to be slowing down anytime soon.

If you thought all the alpha had been leaked, just wait for September.

Off the top of my head, I can already count at least 5 Alpha Tractor posts dropping in the next three weeks alone.

As the great Marcus Aurelius once said “Are you not entertained!?”

See you next week ;)

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!