👨🌾️ Happy NYE! Farm +350% APY via Illuvium staking & check out Unagii Stash

Also, read about the averted Polygon bug + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

DeFi TVL ends 2021 at ~$100B — The total value locked (TVL) in Ethereum DeFi dropped down $85B before rebounding to its present position just shy of $100B. With 2021 now in the books, that means the ecosystem’s officially seen 300% growth from the $25B TVL it notched at this point last year!

🐛 Driving DeFi news this week — Polygon avoids big bug!

On Wednesday, the Polygon team published the details of an emergency network upgrade it conducted earlier this month in order to avoid a “critical network vulnerability.”

That bug, which Polygon became aware of a few weeks ago courtesy of two separate whitehat disclosures, could have allowed an attacker to maliciously mint 9.2B MATIC tokens, a massive trove that would be worth nearly $24B at the current MATIC price of $2.56.

One hacker discovered the vector and did, in fact, make off with ~$2M worth of MATIC. Afterwards Polygon’s creators quickly conducted an emergency hardfork upgrade to permanently avert the vulnerability. Now that the dust has settled some, the episode’s a stark reminder that in DeFi we’re dealing with experimental technologies in adversarial contexts, and as such we should always take into account the possibility of big bugs lurking in the deep.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 BZRX (+76.2%)

📈 FXS (+63.3%)

📈 SUSHI (+59.8%)

📈 DPX (+27%)

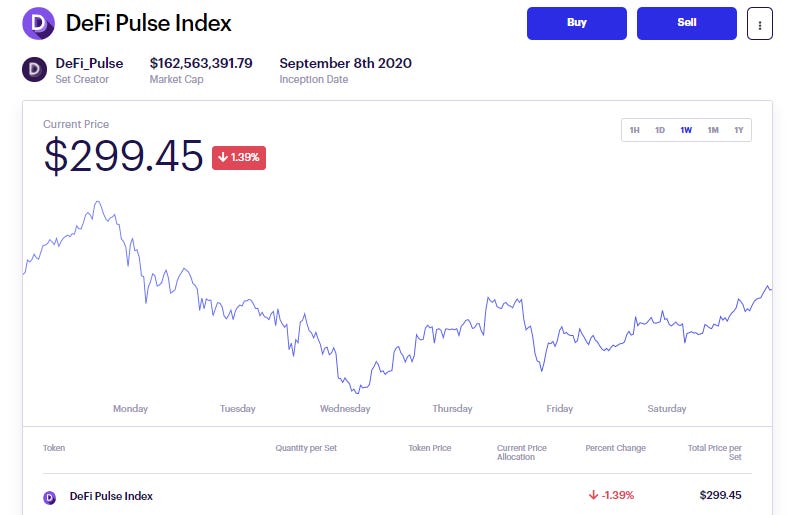

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $299.45, down 1.39% on the week.

🌾 Farm +350% APY with ILV/WETH staking!

Popularized by NFT pets battler Axie Infinity, “play-to-earn” gaming — i.e. blockchain-based games that offer players real earnings possibilities — is a category that saw explosive growth in the NFT ecosystem in 2021.

And while it’s certainly true that Axie Infinity still dominates this category, one of the more interesting play-to-earn oncomers this year was Illuvium.

Founded by Kain Warwick’s brothers Aaron and Kieran Warwick, Illuvium is an NFT auto-battler role-playing game (RPG) on the verge of its second closed beta release. In the meantime, the builders have spun Illuvium’s management out to DAO governance, making the game community-owned and community-managed.

How to stake on Illuvium

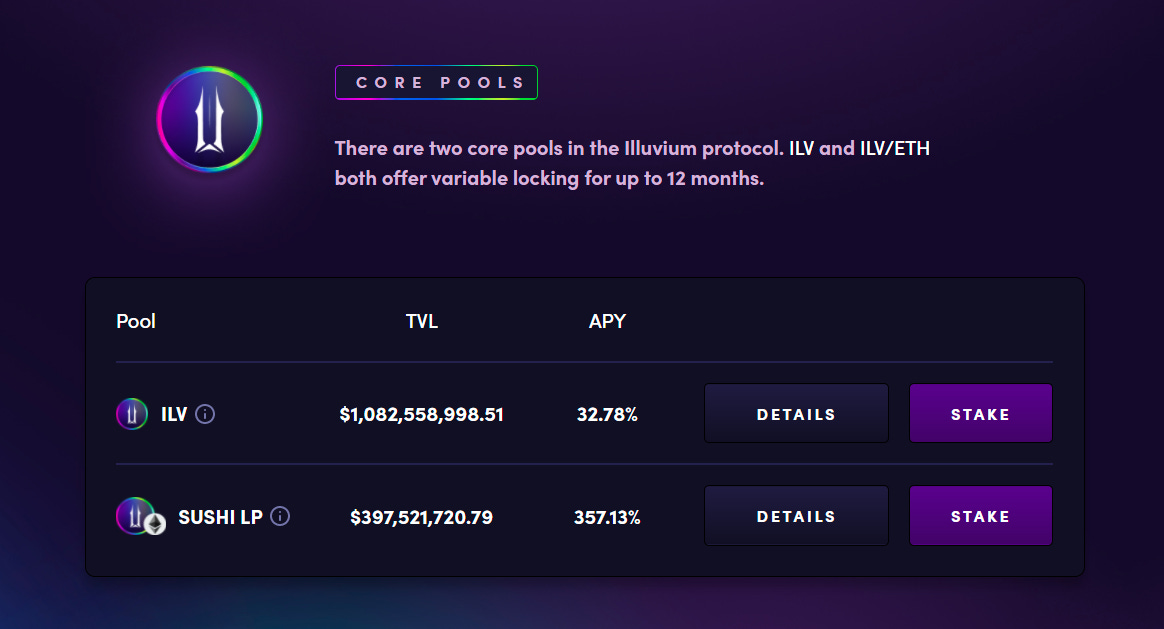

ILV is the governance token of Illuvium, and for now the game’s protocol maintains two core staking pools around it: a single-sided ILV staking pool (which is a nice option for those wanting to avoid impermanent loss) and an ILV-ETH Sushi LP token staking pool (which does come with the risk of IL).

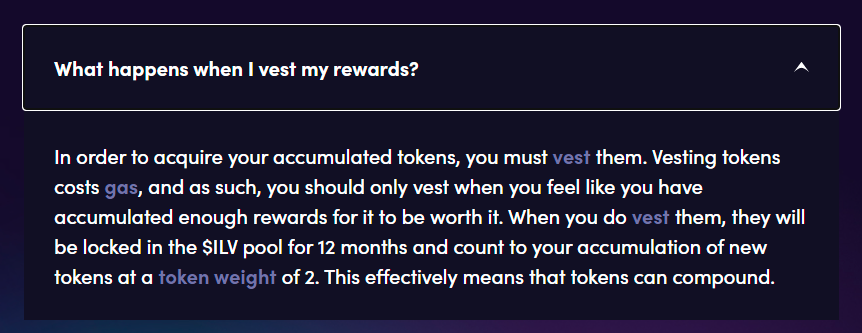

For today’s column we’ll focus on the LP staking token opportunity since it’s currently offering stakers +350% APY via ILV rewards, but before diving in know this: Illuvium stakers must vest their rewards for 12 months before they can freely claim them.

To learn more about the specifics of Illuvium’s staking program, check out the game’s Staking FAQ and Liquidity Mining guide. Yet if you end up deciding you’re okay with the yearlong vesting period, the process to join this staking farm (assuming you already have some liquidity prepped to go) would look like so:

Go to Sushi’s Farm dashboard, connect your wallet, and type “ILV” in the search bar.

Scroll down and click on the ILV-WETH pool. Note: Sushi lets you deposit ETH or WETH at this point.

Input the amount of liquidity you want to provide and follow through with the deposit process. Once your deposit transaction is complete you’ll receive your Sushi LP tokens.

Head over to staking.illuvium.io/staking/core, connect your wallet, and click on the “Stake” button by the Sushi LP option. You’ll have to complete an approval transaction first if this is your first time interacting with the Illuvium protocol.

You can now choose between “Flexible” or “Locked” options. The former offers no ILV reward bonuses, while the latter does in exchange for locking your stake up for up to one year (prior to vesting, that is!).

Once everything is set up how you like it, press “Stake” and complete the staking transaction with your wallet. That’s it, now you’re staking! You can track and vest your rewards as you please via Illuvium’s Overview page.

Again, just keep in mind that this yield farm faces a yearlong vesting period. If that’s not for you, avoid this farm! Also remember that ILV-ETH LPs face the risk of impermanent loss. Lastly, Illuvium has been audited, but you should also treat it as experimental. Never invest more money than you can afford to lose.

The Aave Market for Real World Assets goes live

TLDR: Centrifuge introduces RWA Market, the first diversified real world asset market built on Aave.Finding a Creature in Ethereum’s Dark Forest

TLDR: MEV specialist Robert Miller details an encounter on Ethereum with a mysterious and obscure “dark forest” attacker.10 Predictions for Web3 and the Cryptoeconomy for 2022

TLDR: Crypto exchange giant Coinbase published a list of crypto predictions for next year.A New Era for StakeWise

TLDR: StakeWise announces plans to pivot to Metro, a decentralized staking architecture.

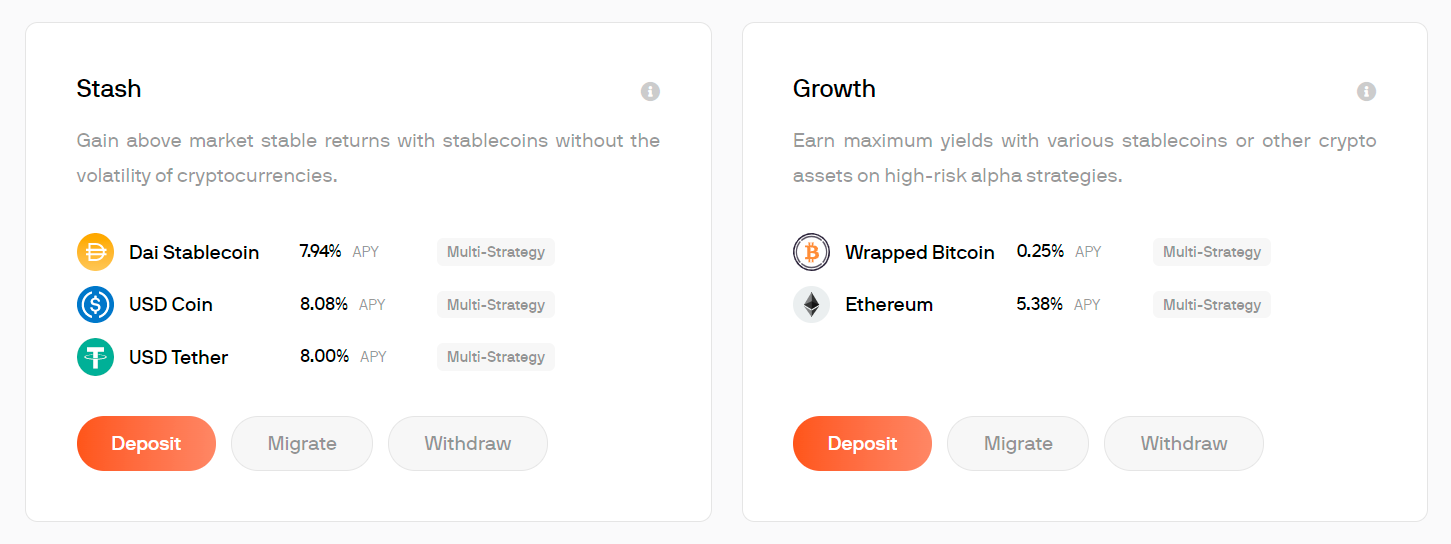

🚜 Farm 8% APR on stables with Unagii Stash!

Looking for solid 8% returns on DAI, USDC, or USDT?

Then you might consider trying Unagii, an upstart non-custodial yield aggregator protocol built by the StakeWith.Us team.

Among the project’s flagship products are its Unagii Vaults, which offer depositors yields on autopilot. The more aggressive of these offerings are the Growth vaults, while the more conservative and stablecoin-focused ones are the Stash vaults.

If you’re interested in trying out the Stash vaults, simply go to the Unagii Vaults dashboard, connect your wallet, and click on your token of choice. Follow through with the straightforward deposit process, and then you’ll be auto-farming with your stables!

Unagii has been audited, but the protocol is also very young and you should approach it as a vulnerable experiment accordingly. Never deposit more money into a protocol than you can afford to lose!

Aave considers deploying its lending market on the StarkNet L2.

Uniswap discusses providing an Additional Use Grant to the Voltz project.

The Opium project unveils non-fungible Cheshire Cats, i.e. NFTs to identify and verify users.

NFT crafting system briq is now in alpha on the StarkNet mainnet.

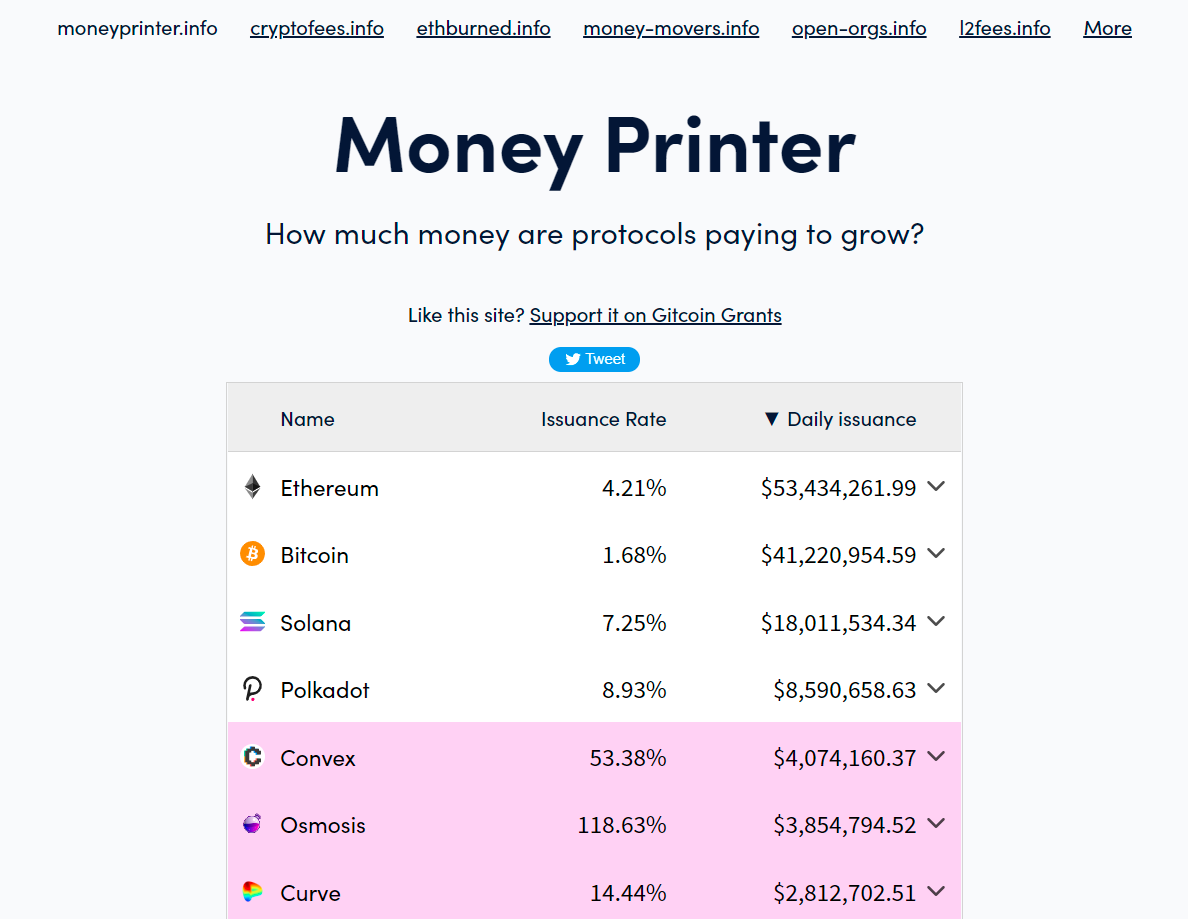

Money Printer is a resource that records and compares the yearly issuance rate of top blockchains and dapps. Understanding a token’s issuance is crucial for understanding its tokenomics in general, so check out Money Printer because it makes tracking this info easy!

What were DeFi Pulse Farmer’s best 2021 highlights? 🤔

Great harvests:

+2,050% APR in CompliFi’s Polygon pastures (Sept. 2021)

+1,000% APY with Gro Protocol (Oct. 2021)

+1,000% APY with Vesper’s vVSP Pool (May 2021)

~985% APR in Instadapp’s new INST/ETH pools (Jun. 2021)

+300% APR in the 1st Dopex yield farms (Aug. 2021)

Major governance votes:

Curve discusses adding a gauge to stETH-ETH pool (Jan. 2021)

Compound votes on enacting Governance Bravo (Mar. 2021)

MakerDAO ratifies DAI Foundation Core Unit (Aug. 2021)

The Fei-Rari merger enters the on-chain governance process (Dec. 2021)

Biggest alpha leaks:

We suggested trying Saddle ahead of the SDL airdrop! (Mar. 2021)

We suggested to try Ribbon ahead of the RBN airdrop! (May 2021)

We suggested pre-farming Lyra ahead of the LYRA launch! (Sept. 2021)

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!